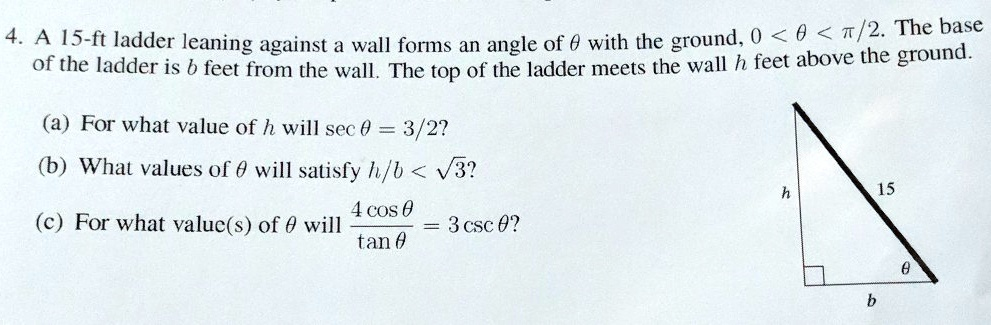

ft ladder leaning against a wall forms an angle of θ with the ground,

The Correct Answer and Explanation is:

Correct Answer: B) Revenue is recognized when it is earned

Explanation:

The revenue recognition principle is a fundamental concept in accrual accounting. It states that revenue should be recorded in the accounting period in which it is earned, regardless of when the cash is actually received. This principle ensures that a company’s financial performance is measured accurately over time.

Under this principle, revenue is considered earned when a company has fulfilled its part of the agreement by delivering goods or services to the customer. For example, if a company provides consulting services in June but receives payment in July, the revenue should still be recorded in June, because that is when the work was completed.

This concept is important because it aligns with the accrual basis of accounting, which aims to present a more accurate picture of a company’s financial position by matching revenues to the periods in which they are earned. This allows investors, creditors, and other stakeholders to make better-informed decisions based on when economic activities actually occur rather than when cash transactions happen.

Let’s break down why the other answer choices are incorrect:

- A) Accounting information is based on actual cost: This describes the cost principle, not the revenue recognition principle.

- C) A company reports details behind financial statements that would impact a user’s decision: This refers to the full disclosure principle, which ensures transparency in financial reporting.

- D) A company records the expenses it incurred in the same period it generated related revenues: This is the matching principle, which complements the revenue recognition principle but is not the same.

In conclusion, the revenue recognition principle ensures that revenues are recorded when they are earned, helping to give a true and fair view of a company’s operations.