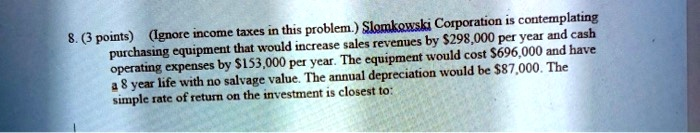

The Correct Answer and Explanation is:

To calculate the simple rate of return, we use the formula:

Simple Rate of Return=Incremental Net Operating IncomeInitial Investment\text{Simple Rate of Return} = \frac{\text{Incremental Net Operating Income}}{\text{Initial Investment}}

Step-by-step Calculation:

- Incremental Revenue: $298,000 per year

- Incremental Cash Operating Expenses: $153,000 per year

- Incremental Net Operating Income Before Depreciation: $298,000 − $153,000 = $145,000

- Depreciation Expense (given): $87,000 per year

- Incremental Net Operating Income: $145,000 − $87,000 = $58,000

- Initial Investment (cost of equipment): $696,000

- Simple Rate of Return:

58,000696,000≈0.0833=8.33%\frac{58,000}{696,000} ≈ 0.0833 = 8.33\%

So, the correct answer is approximately 8.3 percent.

Explanation:

The simple rate of return is a basic yet powerful metric that estimates how profitable an investment will be by relating annual net operating income to the initial outlay. It gives a quick snapshot to investors or managers about how much return they can expect annually from an asset before taxes or financing costs.

In this case, Slomkowski Corporation considers investing in equipment that increases both revenue and operating costs. To assess the return, we first compute the net benefit from those changes—that is, how much additional income results after covering the new expenses, excluding depreciation. Then, we subtract depreciation to find the actual accounting income added annually, since this represents the profit impacting financial statements.

Using this accounting income and dividing it by the original cost of the equipment yields the simple rate of return. This value helps in comparing different investment options or in deciding whether the projected return meets the company’s expectations or hurdle rate. However, it is important to remember that this method does not consider time value of money or cash flow timing, which more advanced methods like net present value or internal rate of return account for.